It may seem a little bit peculiar to you, but there is indeed no limit to how much money you can travel with on a plane. However, there are some rules and regulations to be followed when traveling (internationally) with an amount over $10,000.

The type of flight you are taking, either domestic or international, will determine the maximum amount of cash you are permitted to bring on board without having to fill out any additional documentation.

This article will clear all your doubts regarding “how much money can you travel with on a plane?” And what are the formalities to complete if required?

Contents

How much money can you bring on a plane?

There are some rules and regulations that govern how much cash can you fly with in the US. You have to follow the rules that will depend on whether you are traveling within the country or internationally.

Let’s have a look at different cases in detail.

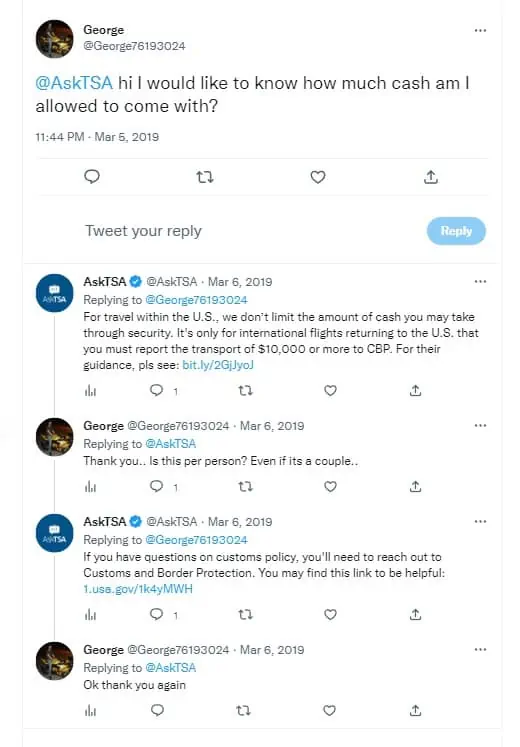

When traveling domestically in the US

If you are traveling within the US, there is no limit on the amount of money you can take on the plane. It can be a million dollars if you want. However, you will not be able to pass smoothly through security at the airport when traveling with a large amount of money.

There is a very high chance that the officers of TSA (Transportation Security Administration) at the screening area will ask a few questions about the money to confirm that it is not for any criminal activities.

TSA will pass the issue to law enforcement (since TSA doesn’t have the power to enforce any law) at the airport if they suspect that the money is associated with some kind of criminal activity like money laundering or drug trafficking.

After that, the money might get seized, and you will need to go to court to get your money back.

Note- If you are landing in the US and changing planes after arriving, you will need to pass through TSA before going on another plane.

When arriving in or leaving the US

There is no limit on how much money you can carry while leaving the US but you have to declare the amount of money to the border officials of the destination country.

As a traveler, you need to know about the rules of the country you are going to or any country you may arrive in before reaching your final destination.

If you are coming to the US with more than $10,000, then you will have to report this to the officials at the airport. You will need to fill out FinCEN Form 105.

If you are traveling in a group such as a family, then you will have to fill out the form for every member of the family. You don’t have to pay any kind of charge for reporting to the border officials.

Where can I get the FinCEN Form 105?

You can get the FinCEN Form 105 from the Border Protection and US Customs officer, or you can download the form from the website of US Customs and Border Protection.

It is always best to fill out the form before your arrival to present it at the time you get to the US.

Note: You have to fill out the FinCEN Form 105 even if you have reported carrying money over $10,000 in the US Customs and Border Protection declaration form.

What happens if you do not declare your money?

It is very important to declare the amount of money you are carrying to the officials. Whether you skip reporting about it purposefully or unintentionally, it will be viewed as a crime or fraud.

In such a case, your money may get seized by the US Government. After that, you will need to go to court to get your money back.

Not reporting the total amount of money can also lead to a penalty of $500,000 and prison for 10 years.

What other things are considered money?

Along with paper money (cash), gold coins, traveler’s checks, and securities or stocks (in bearer form) are all considered as money when traveling on a plane.

“Bearer form” can be explained as a situation where the person holding possession of the stock is considered the owner when there is no owner of that particular stock.

Note: Gold bullion isn’t included in reporting requirements.

Tips to save your money from any losses or theft

You can follow a few simple steps given below to save your money from thieves or any other kind of loss.

- Never put your money in a checked bag, as there is always a chance that you may lose your bag. Always put the money in your carry-on.

- Always keep an eye on your baggage when passing through the checkpoint at security.

- Try to avoid carrying a large amount of money while traveling.

- If any officer from the responsible authority of the airport asks you about the amount of money in your bag, tell them the truth.

- Try to keep the bag in which you have stored the money away from public view.

- If you doubt that your property has been stolen by the employee at the screening area, contact the TSA supervisor.

- https://youtu.be/0lL8-qTZIG4Contact airport police or any law enforcement member immediately if you have become a victim of theft. Remember that the TSA members are not from a law enforcement agency.

To summarize

There is no restriction on the amount of money that can be brought onto the airplane. Although there are no particular issues to deal with while traveling within the United States, you are still required to inform the officials at the border about the amount of money you are transporting into the country.

Additionally, while departing the United States for another country, you will be required to disclose the cash to the authorities at the airport in the destination country. Don’t ignore the advice given to you to safeguard your finances either.

Wishing you a happy and safe journey!

Thanks for reading!

I have been traveling around the world by air since the early 70s and living overseas too. I worked for British Airways for a number of years and I am also a private pilot. About Me